In Pakistan, without interest loan, known as “Qarz-e-Hasna,” are pivotal in promoting financial inclusion and supporting underserved communities. These loans, free from additional charges, empower individuals to meet various needs without the burden of interest payments.

Key Providers of without interest Loans in Pakistan:

-

- Akhuwat Foundation: A non-profit organization offering interest-free loans ranging from Rs. 50,000 to Rs. 500,000. These loans cater to diverse purposes, including family enterprises, agriculture, education, housing, health, marriage, and emergencies. Akhuwat model emphasizes mutual support, inspired by the concept of ‘mawakhat,’ fostering a sense of community and shared responsibility. citeturn0search2

-

- Ehsaas National Poverty Graduation Initiative: This government program provides Without Interest loans between Rs. 50,000 and Rs. 75,000 to new and existing entrepreneurs. The initiative aims to disburse loans to 80,000 beneficiaries monthly, potentially impacting 14.7 million people. citeturn0search1

-

- Meezan Bank: As Pakistan’s premier Islamic financial institution, Meezan Bank offers Sharia-compliant financial products. The bank has experienced significant growth, with its shares rising by 80% in the past year, reflecting the increasing demand for interest-free banking solutions. citeturn0news15

These initiatives exemplify Pakistan’s commitment to fostering economic empowerment and social welfare through interest-free financial solutions, aligning with Islamic principles and promoting community development.

interest free loan in pakistan

Punjab Government Initiatives: In January 2025, the Punjab government introduced two loan schemes—Easy Business Finance and Easy Business Card—to stimulate business activities. The Easy Business Finance scheme offers interest-free loans ranging from Rs1 million to Rs30 million, with flexible repayment options. The Easy Business Card provides loans between Rs500,000 and Rs1 million. These loans are available through the Bank of Punjab, aiming to simplify the process of starting and expanding businesses. citeturn0search0

-

- Alkhidmat Foundation’s Mawakhat Program: This program offers interest-free loans to impoverished families, promoting self-reliance. Loans are provided for small businesses and other needs, with a high recovery rate, ensuring sustainability. Beneficiaries receive social guidance and entrepreneurial training to help them become financially stable. citeturn0search2

-

- Pakistan Poverty Alleviation Fund (PPAF): PPAF administers an Interest-Free Loan Programme across over 100 districts, aiming to alleviate poverty. The program provides loans to target populations through loan centers, with a significant budget allocation, demonstrating the government’s commitment to poverty reduction. citeturn0search3

These initiatives exemplify Pakistan’s dedication to promoting economic empowerment and social welfare through interest-free financial solutions, aligning with Islamic principles and fostering community development.

Akhuwat loan office islamabad

Akhuwat Foundation, renowned for providing interest-free loans, operates two branches in Islamabad to serve the community:

-

- Abpara Branch:

-

- Address: Office No. M-2, Arshad Arcade Plaza, Abpara, Islamabad.

-

- Contact Number: 0325-6406556.

-

- Source: citeturn0search5

-

- G-11 Branch:

-

- Address: G-11 Service Road, Jaffer Chowk, Rab Nawaz Market, G-12, Islamabad.

-

- Contact Number: 0325-6406556.

-

- Source:

For more information or to locate additional branches, please visit Akhuwat’s official branch network page.

Akhuwat loan scheme 2025 online apply

Akhuwat Foundation, renowned for providing interest-free loans in Pakistan, offers various financial products aimed at empowering individuals and fostering economic development. In 2024, they continue to facilitate online applications for their loan schemes, streamlining the process for applicants nationwide.

Available Loan Products:

-

- Family Enterprise Loan: Designed to support the establishment or expansion of small businesses, these loans range from PKR 50,000 to PKR 500,000, with repayment terms between 10 to 36 months.

-

- Agriculture Loan: Targeted at small-scale farmers, including landless tenants, these loans assist in purchasing agricultural inputs and covering related expenses. Loan amounts vary from PKR 50,000 to PKR 500,000, with durations of 4 to 8 months.

-

- Education Loan: Aimed at deserving students from low-income backgrounds, these loans help cover educational expenses. Amounts range from PKR 50,000 to PKR 500,000, with repayment periods of 10 to 24 months.

Application Process:

To apply for an Akhuwat loan online in 2025, follow these steps:

-

- Visit the Official Website: Navigate to Akhuwat’s official loan application page.

-

- Select Loan Type: Choose the loan product that aligns with your needs.

-

- Fill Out the Application Form: Provide accurate personal and financial details as required.

-

- Submit Necessary Documents: Upload scanned copies of required documents, such as your Computerized National Identity Card (CNIC).

-

- Review and Submit: Ensure all information is correct before submitting your application.

Eligibility Criteria:

Applicants must meet the following general criteria:

-

- Possession of a valid CNIC.

-

- Ability to initiate or manage a business activity.

-

- Age between 18 and 62 years.

-

- Economic activity status.

-

- No ongoing criminal proceedings.

-

- Good social and moral standing in the community.

-

- Capacity to provide two guarantors, excluding family members.

-

- Residence within the operational area of the branch, typically within a 2 to 2.5 km radius.

For detailed information on specific loan products, application procedures, and branch locations, visit Akhuwat’s official website:

To further assist applicants, here’s a video detailing the Akhuwat loan application form and process:

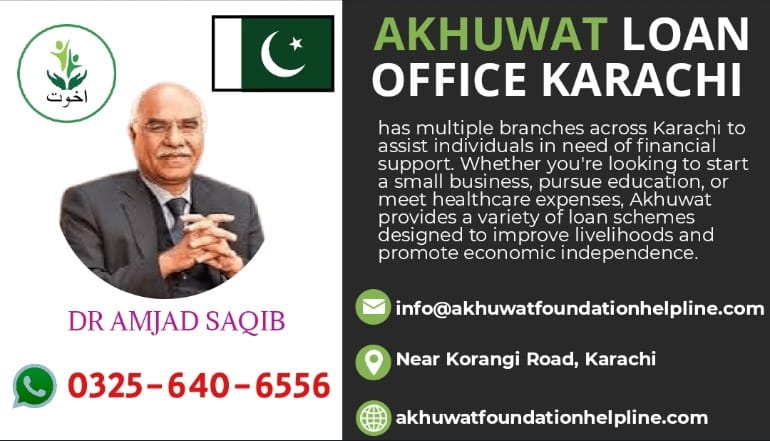

Akhuwat loan office karachi

has multiple branches across Karachi to assist individuals in need of financial support. Whether you’re looking to start a small business, pursue education, or meet healthcare expenses, Akhuwat provides a variety of loan schemes designed to improve livelihoods and promote economic independence.

Akhuwat Loan Offices in Karachi:

-

- Akhuwat Karachi Branch 1

-

- Location: Near Korangi Road, Karachi.

-

- Contact: +92-325-064-6556

-

- Akhuwat Karachi Branch 2

-

- Location: Saddar, Karachi.

-

- Contact: +92-325-064-6556

These branches facilitate easy access to Akhuwat loan schemes. Applicants can visit these offices or apply online through the official website to access the Qarz-e-Hasna (interest-free loan) for their business, education, or personal needs.

For more details on loan products, application processes, and eligibility criteria, visit Akhuwat official website. Empower your future with Akhuwat financial assistance today!

Loan without interest in pakistan 2025

In 2025, Pakistan continues to offer interest-free loans through various initiatives, providing vital support to individuals and businesses. Organizations like Akhuwat Foundation offer Qarz-e-Hasna (interest-free loans) for small businesses, education, healthcare, and more. Additionally, government-backed schemes such as Ehsaas Program and Punjab’s Easy Business Finance offer interest-free loans to empower low-income families and entrepreneurs. These loans help improve financial inclusion, reduce poverty, and promote entrepreneurship. Applicants can access these services online or through designated branches in major cities, ensuring a broad reach to those in need across Pakistan.